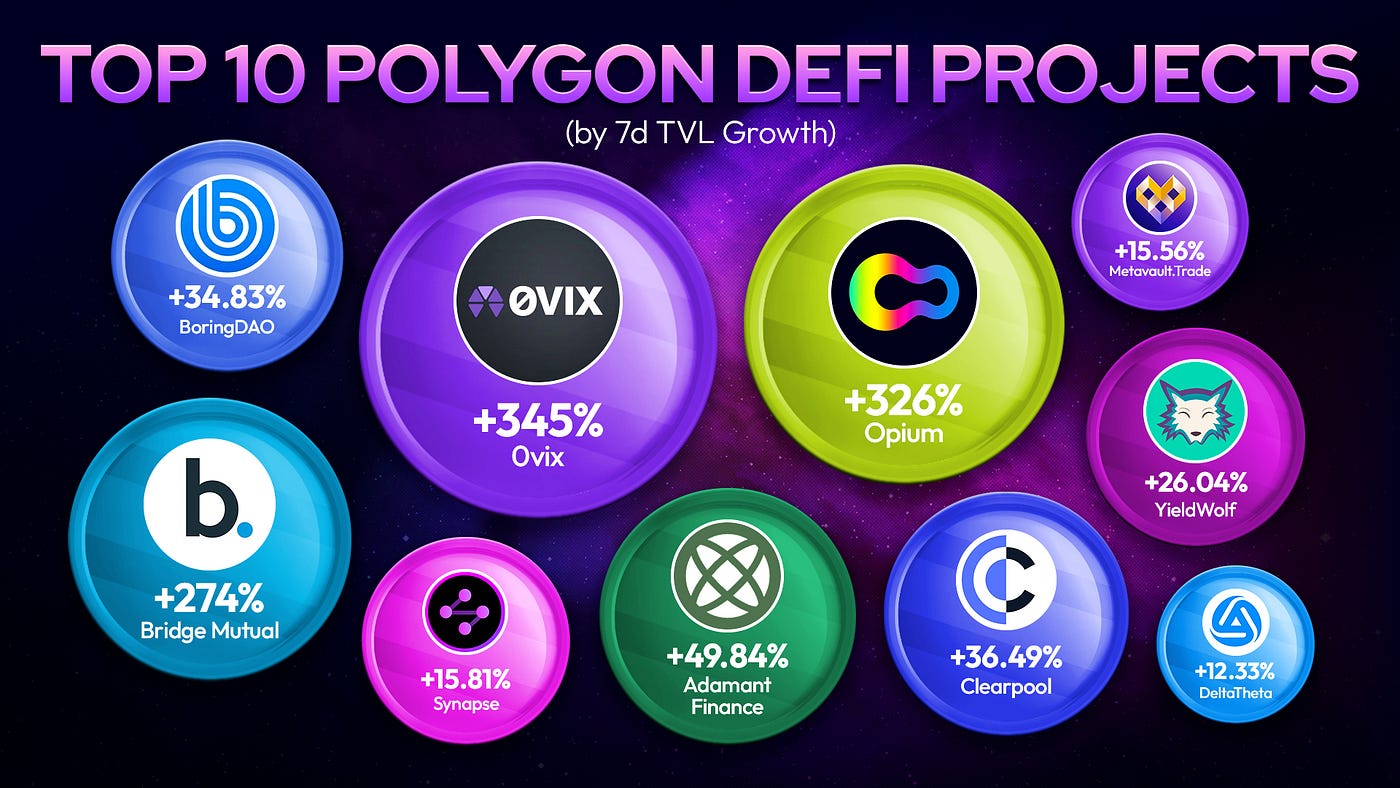

Metavault.Trade

- Decentralized place & eternal exchangeKum

Metavault.Trade is an exchange platform that provides a decentralized crypto exchange service designed with various crypto features. Metavault.Trade provides spot & perpetual exchange services that allow users to trade with leverage up to 30x and directly from their personal wallet.

Metavault.Trade is an innovative decentralized exchange platform because it provides a spot & perpetual exchange service where users can trade safely and easily without going through an account, but just by connecting their wallets and they will be able to trade. So this is a decentralized crypto exchange platform with leverage and convenience for users.

Metavault Trade is a decentralized and perpetual exchange with low swap fees and trading without price impact. Trades are supported by multi-asset pools, which in turn are supported by liquidity providers.

Trades are supported by multi-asset pools, which in turn are supported by liquidity providers. Liquidity providers receive compensation through swap fees, market making, rebalancing and leveraged trading. MVX uses Oracle Chainlink and TWAP pricing from large volume decentralized exchanges for dynamic pricing.

Metavault.Trade

Metavault.Trade is a new type of Decentralized Exchange, designed to provide a wide variety of trading features and very deep liquidity on many large-cap cryptoassets.

Traders can use it in two ways:

Spot trading with swaps and limit orders.

Perpetual Futures trading with leverage up to 30x on short and long positions.

Metavault.Trade aims to be an entry solution for traders who want to keep control of their funds at all times without sharing their personal data. Its innovative design provides many advantages compared to other existing DEXs:

Very low transaction fees.

There is no price impact, even for large order sizes.

Protection against liquidation events: sudden price changes that often occur in one exchange ("scam wicks") are smoothed by the design of the pricing mechanism that relies on Chainlink price feed. All-in-one platform: Spot and Leverage trading.

Problem

Most crypto users today trade through centralized exchange platforms. Through this exchange platform, users will be able to trade crypto easily and securely. But the problem is that usually centralized exchange platforms use KYC for their trading which is problematic for some people because it is related to their identity and privacy. Whereas users should be facilitated with a crypto trading platform that will make it easy for them to trade and not ask for their identity so users will be able to trade freely without worrying about their privacy.

The solution

And in response to this problem, Metavault.Trade was launched as a decentralized exchange platform that will not ask for the identity of its users. This service is provided by Metavault.Trade is a decentralized & timeless exchange, which will allow users to trade quickly and securely with leverage through their personal wallet. As it only requires a connection to the user's digital wallet, it means that Metavault.Trade does not require the creation of an account for the user. Users will be able to trade their favorite pairs freely without worrying about their privacy.

Metavault Exchange Features

● Low Fees - Very low transaction fees.

● There is no price influence, even for large order sizes.

● Simple Swap - Open a position through a simple swap interface. Easily switch from any supported asset to your preferred position.

● Reduced Liquidation Risk - Protection against liquidation events: sudden price changes that often occur in one exchange ("scam wicks") are smoothed out by the design of the price mechanism.

● Complete platform: spot trading and leverage.

● Multi-asset pool - The key innovation at the heart of Metavault.Trade is the multi-asset pool. This feature allows the platform to share liquidity across all the assets it supports.

The Metavault.Trade Ecosystem

● MVLP (Liquidity Provision Incentive) - MVLP is the platform's liquidity token. Metavault.Trade requires a multi-asset pool with plenty of liquidity. To ensure this happens, the platform has a very generous incentive program: 70% of the platform's fees are distributed back to liquidity providers who print MVLP by pooling their crypto assets. MVLP acts as a balancer for leveraged traders on the platform, with their losses flowing back to MVLP.

● MVX - Metavault.Trade has its own governance and utility token: MVX. Holders are incentivized to hold out for the long term, with many rewards that will accumulate quickly. MVX marketers will get 30% of the fees collected by the platform in the form of the network's native token — MATIC on Polygon.

- MVX is Metavault.Trade's governance and utility token.

Token Information Token address After

MVX stake MVX, You will receive MVX staked: MVX staked token address: MVX staked staking results in three types of rewards: MATIC esMVX Multiplier Points 30% of swap and leverage trade fees are converted to $MATIC and distributed to MVX staking accounts. LP MVX-USDC Liquidity Treasury Assets is provided and owned by Protocol (). 100% of the fee from this trading pair is converted to USDC and deposited to MVLP as liquidity belonging to the Protocol every Friday. Supplying

The maximum supply of MVX is 10,000,000. Printing beyond this maximum supply is governed by a 28-day time lock, a possibility that will only be considered if protocol demands require an increase in supply.

The change in circulating supply is determined by the amount of tokens distributed through other DEXs, vested, burned, and spent on marketing.

Multi-Asset Group

The great innovation at the heart of GMX, and now Metavault.Trade, is the Multi-Asset group. All the assets supported by the platform are collected together and the token called MVLP represents the index of this token. The MVLP price will fluctuate with the price of the underlying asset in the basket and the traders' Profit and Loss (PnL) — when they lose on the trade, their losses flow to the MVLP.

How does this mutual liquidity result in lower price impact exchange solutions? Let's say for example that the pool consists of five assets (BTC, ETH, MATIC, USDC, and DAI) in equal proportion in terms of dollar value: 20% each. If a trader wants to buy 50% of the BTC supply with USDC, they can do so instantly, without any price impact. Once the order is completed, the pool status will be BTC: 10%, USDC: 30% and the rest is unchanged. To understand how unique this feature is, I encourage you to check how much price impact you get for very large orders on CEX with an order book or on a DEX like Uniswap!

Tim

Metavault.Trade is built by professionals and experts in their field who have years of experience in blockchain technology and understand the crypto market. The team collaborates together to develop a decentralized exchange that will be used by many people globally easily and securely. With this collaboration, it is hoped that users can obtain the best service, where they can transact safely, quickly, and at a lower cost through their devices.

Tokenomics and Community

Metavault.Trade was developed by the team behind Metavault DAO , which powers the entire blockchain ecosystem and technology project.

This code is a friendly fork of GMX, which has been audited by ABDK Consulting [ Find the audit here with the name “Gambit”, the original name of the GMX project].

As safety is paramount, an independent audit will be carried out in the near future.

After carefully considering GMX's tokenomics, the DAO Metavault team chose to completely redesign Metavault.Trade. The main differences are as follows:

- Compared to GMX, Metavault.Trade allocates a higher proportion of tokens to value agriculture. That makes the incentive program much broader.

- MVX tokens are launched in a fair way, without private spins or seeds.

Metavault DAO is meant to be a liquidity provider on Metavault.Trade, making it strong and independent.

There is already a strong community supporting Metavault.Trade, as follows through Telegram and Discord channels. Sharing 100% of platform costs between MVX and MVLP holders/players — in addition to a carefully planned incentive structure — means the project will attract and retain backers in the long term.

How to buy Continental & Trade On Exchange?

Metavault Trade Decentralized Perpetual Exchange

Trade top cryptocurrencies with up to 30x leverage directly from your personal wallet.

Reduce the risk of liquidation

Total high quality price feed determines when liquidation occurs. This keeps the position safe from temporary fuses.

Cost saving

Enter and exit positions with minimal spread and no impact on price. Get the best price at no extra cost.

Simple Exchange

Open positions through a simple swap interface. Easily switch from any supported asset to your preferred position.

Available on the following networks

Metavault Trade is currently being implemented on Polygon Network and Fantom Opera. Proximity Protocol is coming.

FOR MORE INFORMATION CONTACT:

Website: https://metavault.trade

Telegram: https://t.me/MetavaultTrade

Twitter: https://twitter.com/MetavaultDAO

Media: https://metavault.medium.com

Discord: https://discord.com/invite/b2fPrbmPza

Github: https://github.com/metavaultorg

Docs: https://docs.metavault.trade

by yara762 url link https://bitcointalk.org/index.php?action=profile;u=2979065

Ulasan

Catat Ulasan